42 muhammad yunus grameen bank

In 1983, Dr. Yunus' education, international experience, and on-the-ground work culminated in the founding of Grameen Bank, a microfinance organization and community development bank. Since its creation, Grameen Bank has provided $6.5 billion in collateral-free loans to 7.5 million clients in more than 82,000 villages in Bangladesh, with ... Muhammad Yunus pioneers the idea of microfinance Muhammad Yunus came to Ford with a vision to provide Bangladesh’s low-income communities with small loans to gain financial power and security. This work developed into the Grameen Bank—which today has more than 8 million borrowers across Asia, of which 97 percent are women—and earned Yunus a Nobel Prize and Presidential Medal of Freedom.

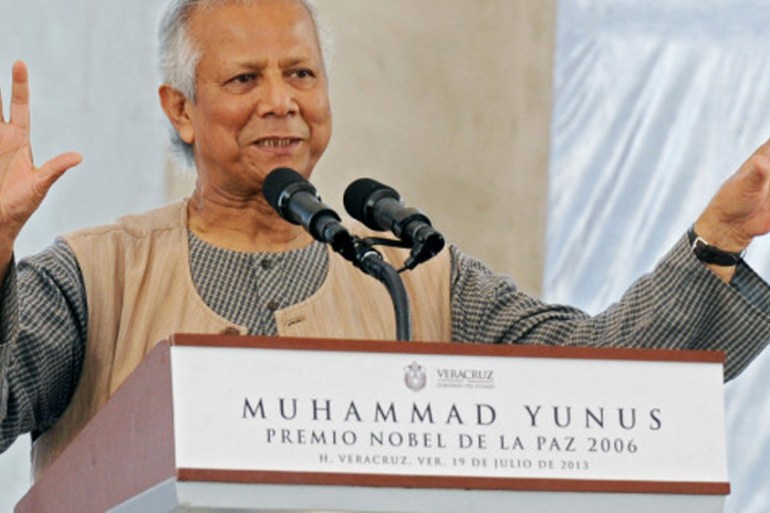

Since October 2006, when Professor Yunus and Grameen Bank jointly received the Nobel Peace Prize, local and international interest in Professor Yunus' work has continuously increased. In order to address this ever-growing attention, an organization aimed primarily at promoting and disseminating Professor Yunus' philosophy, with a special focus on social business, was created in the form of the ...

Muhammad yunus grameen bank

Recipient of the 2006 Nobel Peace Prize, Professor Muhammad Yunus is internationally recognized for his work in poverty alleviation and the empowerment of poor women. Professor Yunus has successfully melded capitalism with social responsibility to create the Grameen Bank, a microcredit institution committed to providing small amounts of working ... Professor Muhammad Yunus and Grameen Bank, which he founded, were jointly awarded the Nobel Peace Prize in 2006 "for their efforts to create economic and social development from below." Since then, Professor Yunus has focused on spreading and implementing the concept of "social business" — companies created for social good rather than private profit — through Yunus Social Business ... Catherine Turner is Associate Professor of International Law at Durham University. Her areas of research and teaching expertise span the international law of peace and security, including international humanitarian law, peace mediation, transitional justice and women peace and security. She has published widely in the fields of peace mediation and transitional justice, and has an extensive ...

Muhammad yunus grameen bank. Grameen Bank (Bengali: গ্রামীণ বাংক) is a microfinance organisation and community development bank founded in Bangladesh.It makes small loans (known as microcredit or "grameencredit") to the impoverished without requiring collateral.. Grameen Bank originated in 1976, in the work of Professor Muhammad Yunus at University of Chittagong, who launched a research project to ... Muhammad Yunus (born 28 June 1940) is a Bangladeshi social entrepreneur, banker, economist and civil society leader who was awarded the Nobel Peace Prize for founding the Grameen Bank and pioneering the concepts of microcredit and microfinance. These loans are given to entrepreneurs too poor to qualify for traditional bank loans. Yunus and the Grameen Bank were jointly awarded the Nobel Peace ... Muhammad Yunus has been a poster boy for the microfinance industry. In 2006 Muhammmad Yunus and the Grameen Bank were awarded the Nobel Peace Prize in recognition of his pioneering work in the ... Through the Grameen Bank Muhammad Yunus shows, how even in a Muslim setting, micro-finance banking can be successfully implemented on a secular base. The first chapter of this paper will characterize the peculiarities of Islamic Banking, showing the basic principle of avoiding usury by avoiding the demand of interests (riba). ...

In the early 1970s, Professor Muhammad Yunus envisioned a means of alleviating poverty by circumventing the major impediment to lending to the poorest in society—the need for collateral. He tested this instinct in an experiment in 1976, when he lent about $27 to 42 women in an ordinary Bangladeshi village. Just 30 years later, Grameen Bank ... THE NOBEL PEACE PRIZE 2006 MUHAMMAD YUNUS, GRAMEEN BANK The Nobel Peace Prize 2006 was awarded jointly to Muhammad Yunus and Grameen Bank "for their efforts to create economic and social development from bellow" Find more information THE NOBEL PEACE PRIZE 2006 MUHAMMAD YUNUS, GRAMEEN BANK The Nobel Peace Prize 2006 was awarded jointly to Muhammad Yunus and Grameen Bank "for their efforts to ... 2 päivää sitten · Inspired by the work of Nobel Laureate Prof Muhammad Yunus, Grameen provides works in partnership with leading development organizations in India to ideate, innovate and scale breakthrough solutions that reach underserved populations, particularly … Biographical. Professor Muhammad Yunus established the Grameen Bank in Bangladesh in 1983, fueled by the belief that credit is a fundamental human right. His objective was to help poor people escape from poverty by providing loans on terms suitable to them and by teaching them a few sound financial principles so they could help themselves.

Muhammad Yunus, who won the Nobel peace prize for founding Grameen Bank, has fought attempts to unseat him. Photograph: Bloomberg/Bloomberg via Getty Images Jason Burke in Mumbai and Saad Hammadi ... Founder - Grameen Bank. Muhammad Yunus was born on 28 June, 1940 in the village of Bathua, in Hathazari, Chittagong, the business centre of what was then Eastern Bengal. He was the third of 14 children, of whom five died in infancy. Muhammad Yunus, founder and managing director of Bangladesh's Grameen Bank, was the guest speaker at Wharton's MBA commencement on May 17 and the recipient of an honorary doctor of laws degree ... Global X has had many chats with Muhammad Yunus, but most of the time when the 2006 Nobel Peace Prize laureate was talking to other interesting people, such ...

Muhammad Yunus and Grameen Bank were awarded the Nobel Peace Prize for 2006 for their work to "create economic and social development from below". Grameen Bank's objective since its establishment in 1983 has been to grant poor people small loans on easy terms - so-called micro-credit - and Yunus was the bank's founder.

30.11.2021 · Prof. Muhammad Yunus Nobel Laureate Founder of Grameen Bank “I was totally satisfied, both with the method of disbursement and the target population. Instead of spending money on yearly rituals on my parents’ death anniversary, I donate the amount to Akshaya Patra.

• His Grameen Bank began as a branch of a government bank and became an independent multinational institution. • Yunus has broadened his work beyond banking, but "microcredit" remains his focus.

From Muhammad Yunus' Grameen Bank in Bangladesh to Europe, microfinance is already a reality that supports entrepreneurs and social inclusion. In the beginning was Muhammad Yunus . It was 1974, Bangladesh had been hit by a devastating flood followed by a severe famine, and Yunus lent 27 dollars to a group of women of the city of Jobra, nearby ...

MONTHLY REPORT: 08-2021 IN USD. Statement No: 1 Issue No. : 500, Issue Date : September 06, 2021 Grameen Bank Monthly Update In USD: August 2021 Sl. No Particulars In…. Read More. Monthly Reports. Posted on.

Dr Muhammad Yunus Nobel Peace Prize Laureate And Managing Director Of Grameen Bank Stock Photo Alamy

Muhammad Yunus, the Bangladeshi economist, widely known as the Father of Microfinance founded the Grameen Bank to make small loans to the poor in Bangladesh. Dr Yunus was greatly influenced by his mother who was known to never turn away anyone in need. The famine that hit Bangladesh in 1974 pushed him to do something about poverty.

Grameen Bank Pti Exclusive See No Reason For Grameen Bank Operations In India Muhammad Yunus The Economic Times

Since October 2006, when Professor Muhammad Yunus and Grameen Bank jointly received the Nobel Peace Prize, local and international interest in Professor Yunus' work has grown exponentially. To address this ever-growing need, Professor Yunus founded Yunus Centre in July 2008 to promote and disseminate his work and philosophy, especially the concept and practice of social business.

Redesigning Capitalism Muhammad Yunus Founder Of Grameen Bank Nobel Laureate Direct Talk Tv Nhk World Japan Live Programs

Muhammad Yunus and Bangladesh government battle over Grameen Bank. The 8.3 million women who form the bulk of the Nobel-winning microfinance bank's shareholders could be the losers. Muhammad Yunus ...

The loser in this case: Muhammad Yunus, Nobel Peace Prize laureate and founder of Grameen Bank, the groundbreaking Bangladeshi microfinance institution (MFI) he is no longer allowed to run ...

The EEA intends to use Grameen Bank model, developed by Nobel Peace Award winner, Muhammad Yunus. EEA intends to reach out to 10,000 poor families in Tanzania with microloans in the next five years in Gongolamboto, Kinyerezi, Chanika and Kigamboni. Achieving this goal EEA will ...

Muhammad Yunus is Grameen founder . He was born on 28th June, 1940 in the village of Bathua , Chittagong, the business centre of what was then Eastern Bengal. He was the 3rd of 14 children of whom five died in infancy. His father was a successful goldsmith .

The Grameen Bank was created by Professor Muhammad Yunus, a Bangladeshi economics professor who, during the famine of 1974, felt compelled to reach out to the Bangladeshi poor in an effort to understand why they were unable to achieve economic success.

Action: With a mission to interact, incubate and create, Yunus created the world's first bank for the poor, with a focus on rural women. The bank now has revenue of US$178 million and employs more than 22,000 people. He won the Nobel Peace Prize in 2006. www.GrameenCreativeLab.com. Real Leaders is the world's first sustainable business ...

In 1976, Yunus institutionalized the approaches of microfinance, along with the foundation of Grameen Bank in Bangladesh. Since, in the developing countries, a large number of people still depends largely on subsistence farming or basic food trade for their livelihood, therefore, smallholder agriculture in these developing countries has been supported by the significant resources.

Grameen Bank. I have been conducting research on the leadership of Muhammad Yunus for the last three years. When I went back to Bangladesh in January 2010, I interviewed him twice, for two hours each time. While there, I also interviewed 14 others who know Yunus in various capacities—people who work at Grameen, two of his brothers, and an ...

Prof. Muhammad Yunus is a Bangladeshi economist and founder of the Grameen Bank, an institution that provides microcredit to help its clients establish credi...

Catherine Turner is Associate Professor of International Law at Durham University. Her areas of research and teaching expertise span the international law of peace and security, including international humanitarian law, peace mediation, transitional justice and women peace and security. She has published widely in the fields of peace mediation and transitional justice, and has an extensive ...

Professor Muhammad Yunus and Grameen Bank, which he founded, were jointly awarded the Nobel Peace Prize in 2006 "for their efforts to create economic and social development from below." Since then, Professor Yunus has focused on spreading and implementing the concept of "social business" — companies created for social good rather than private profit — through Yunus Social Business ...

Recipient of the 2006 Nobel Peace Prize, Professor Muhammad Yunus is internationally recognized for his work in poverty alleviation and the empowerment of poor women. Professor Yunus has successfully melded capitalism with social responsibility to create the Grameen Bank, a microcredit institution committed to providing small amounts of working ...

What Did I Do Wrong Why The Banker Who Helped Millions Of Bangladeshis Out Of Poverty Became His Country S Enemy Number One The Independent The Independent

0 Response to "42 muhammad yunus grameen bank"

Post a Comment